Chapter 2.3 Maximise returns from your wool sales

Chapter 2.3 Maximise returns from your wool sales

Background information

Many options exist for the marketing of your wool clip. Understanding the value of your wool before sale can assist in assessing marketing options and the use of price risk management tools. Knowing where current prices sit in relation to historical values can also help reveal the current point in commodity price cycles.

At a glance

- Use AWEX and your wool broker to estimate the value of your wool.

- Use your wool value estimates to set auction reserve prices or negotiate direct sales.

- Consider wool selling options 4–6 months ahead of shearing and evaluate a range of methods.

- Develop strategies to manage price unpredictability before shearing and keep under regular review.

Woolgrowers have many selling options available to them. The options will vary according to the scale of your enterprise, and the characteristics of the wool you produce (micron, market speciality). To secure the true market value of your wool, work with your wool broker or advisor when using any of these selling options. The more commonly used methods include:

- Open-cry auction – the most common method of sale, accounting for about 90% of Australian wool production. This system is facilitated and managed by wool brokers, guarantees payment, and allows maximum exposure and competition for wool at sale time, with all major buyers of Australian wool present in the auction rooms.

- Private treaty – prices are negotiated privately with buyers at or about the time of shearing. Wool may be sold either tested or untested, however, untested wools will not be paid the same as tested wools.

- Forward sales – a contract is made before shearing to deliver wool to an agreed specification and to an agreed price schedule. Payment is made against the actual test results. Remember that once contracted, your wool must meet specifications.

- Direct to topmaker/exporter – a spot sale through an exporter for delivery direct to a topmaker. Negotiation of the final price in Australian currency must be managed carefully to eliminate fluctuations in currency exchange rates.

- Online selling – electronic offer board where wool is available for sale to buyers 24 hours a day, 7 days a week. A reserve price is ‘posted’ (presented for sale on computer screen) and can be simultaneously seen by all registered buyers. Submission of bids and final sale is facilitated via the offer board, and not directly with the seller. The most significant advantage of an electronic offer board comes in a rising market, when it allows buyers to purchase wool lots outside the scheduled auctions.

- Grower marketing groups – grower-based marketing groups established to sell direct to processors and manufacturers. Grower marketing groups need a structure, training and a sound business case to succeed and be profitable over time.

- Wool pools – A contract is made to deliver a volume of a shearing or yearly production to the pool up to 12 months prior to shearing. By participating in the pool you are assigning the risk management of you wool portfolio to a third party. The aim is to reduce exposure to price volatility. An upfront payment occurs after delivery based on a percentage of the current market. At the close of the pool a final payment is made based on the performance of the pool against the physical market. This option also includes traceability, downstream education and opportunities for contact with end use customers.

- Grid sales – similar to selling livestock “over the hooks”, prices are offered from a set grid of prices for wool delivered to store. Prices are generated from all stages of the demand chain as the various businesses feed direct orders from the pipeline. Most wool selling brokers will offer some form of grid sales or a price at door pricing system for their clients.

- Partnership processing (retained ownership) – some processors offer an option to growers allowing the grower to retain ownership of the wool beyond the greasy form. By using downstream manufacturers infrastructure, a grower can participate in the value add of wool from top to yarn to garment. This partnership results in a sharing of the profit as wool is transformed into retail products.

If immediate sale prospects are poor at the time of shearing and the outlook is for improving price, consider holding wool in store pending a later sale (defer selling). Alternatively, sell part of the clip (split selling) and defer the remainder to a time of lower supply. Work closely with your wool broker or advisor and be aware of storage costs and the time value of money.

Valuing your wool

Your wool broker is the best source of pricing information via their appraisal. Brokers’ appraisals incorporate a visual inspection of your wool in the sample box, anticipated market movements and the quantity of offerings in the forward weeks to provide an estimate of what your wool will achieve at auction.

Selling options

Plan your selling system 4–6 months before shearing commences. The final choice will be determined by a number of factors including:

- Short- to medium-term market outlook and projected price trends

- Estimates of the value of your wool using information from valuations and forward markets

- Prices on offer relative to that valuation and expected price trends

- Estimates of selling and possible storage costs

- Your own financial circumstances, including your cost of production

- Potential risks of market volatility and your approach to managing price risks.

It is recommended that you monitor market conditions and review approaches to selling regularly.

Managing price volatility

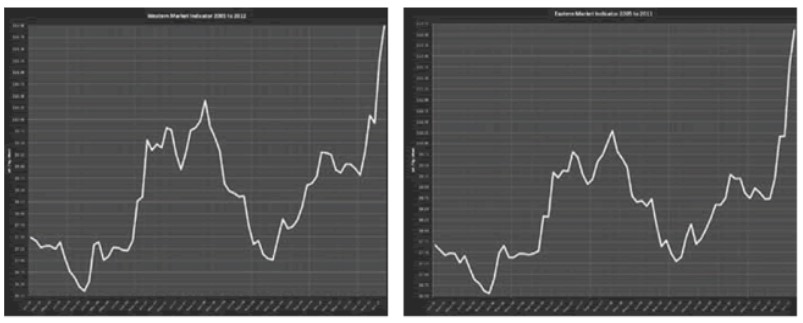

The profitability of your enterprise is determined by a combination of seasonal conditions, your personal management programs, and wool price cycles. Wool prices, like all commodity prices, move in cycles, as shown in figure 2.1 below.

Figure 2.1 Commodity price cycles in key wool markets over 15 years.

Source: The Woolmark Company

Price risk management programs and products can help protect your profitability from volatile commodity prices and the vagaries of the weather.

Wool brokers and advisors can access a wide variety of price risk management tools around the world to help reduce the uncertainty of future cash flows. It is important to seek professional advice to understand the practicalities and implications when developing strategies to manage price risk. Options include:

- Making use of forward selling or hedging options such as selling wool futures before shearing.

- Accessing price risk management tools through a wool agent or exporter. This eliminates most of the risk of price fluctuation, but production and wool quality risk remains.

- Exploring fixed price wool indicator contracts, wool minimum price facility, and deferred price contracts.

Some on-farm approaches to managing the current market situation and possibility of price volatility at the time of sale include:

- Spreading the risk by offering your clip over more than one scheduled sale

- Setting well researched and realistic reserves to protect against downside risk of price fluctuations and maintain flexibility up to the time of sale.

Holding wool in storage requires an assessment of the likely storage costs and financial impact of a delay in wool sales against the potential for price gains when wool is finally sold.

SIGNPOSTS

READ

Undertaking a broad review of the global market for wool and competitor fibres, AWI is able to provide wool production forecasting, retail and trade market reports, consumer insights and trend monitoring, along with fibre market research.

Once your wool is in-store and tested with your regular broker, or it has gone to live auction and been passed-in, it can be listed online. Buyers have the option to inspect your samples, and once approved, the sale can be processed.

As well as offering a range of daily and weekly market summaries detailing the current market movements, AWEX Market information provides real-time data during Australian wool auctions.

The latest on the Australian wool market direct from the Elders wool team.

Stay up to date with what’s happening in the wool market from the team at Nutrien.

What did the wool market do this week? Hear from AWN.

Market commentary from Macdonald & Co Woolbrokers.

As well as offering a range of daily and weekly market summaries detailing the current market movements, AWEX Market information provides real-time data during Australian wool auctions.

Every week, Quality Wool brings you a summary of the week in wool.

Weekly report and information pages from Schute Bell Badgery Lumby.

Jemalong Wool market insights.

USE

The NWD is used to declare animal welfare practices and Dark and Medullated Fibre Risk (DMFR) to wool exporters, processors and retailers. It is the trusted declaration method for Australia and once completed, the information is converted by the wool selling agent for inclusion in sale catalogues and test certificates.

An industry owned and led initiative, the Hub is an opportunity for the Australian wool industry to get ahead of the curve when it comes to Australian wool's Emergency Animal Disease response plan as well as end-to-end commercial traceability from farm to first stage processor. For Woolgrowers, it provides ease of access to all their clip test information.

Broad based risk management products that can be used for hedging and trading Australian wool. Maturity dates extend out up to three wool clips and coincide with key wool auction dates.

ATTEND

An in-depth look at the importance of wool price risk management and hedging principles. The content covers types of risk, risk management products, strategies and analysis and shows how a better understanding of these elements can enable an increased uptake of forward contracts and lead to improved market signals.